Revolutionize Your Sustainability Strategy with RECs and PPAs

In the realm of sustainable energy, Renewable Energy Certificates (RECs) and Power Purchase Agreements (PPAs) stand out as game-changers. Delve into the intricacies of these mechanisms, understanding how they can revolutionize your business's approach to energy consumption, reduce your carbon footprint, and contribute to a sustainable future.

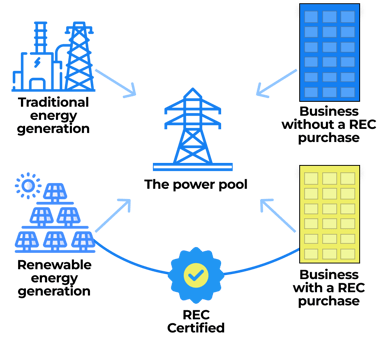

Understanding RECs (Renewable Energy Certificates):

1. Definition: RECs represent the environmental attributes of renewable energy generation. When a renewable energy facility generates one megawatt-hour (MWh) of electricity, it produces one REC.

2. How It Works: Businesses can purchase RECs to offset their own carbon emissions. By doing so, they support the production of renewable energy elsewhere, contributing to a cleaner energy grid.

3. Environmental Impact: RECs offer a credible way to claim and demonstrate your commitment to renewable energy without physically sourcing energy directly from a renewable facility.

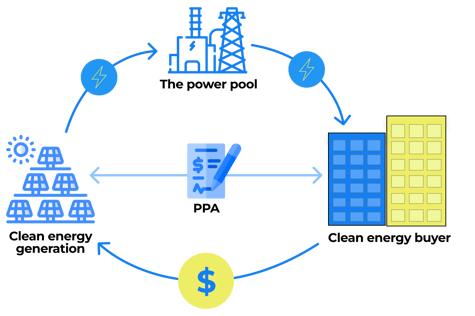

Understanding PPAs (Power Purchase Agreements):

1. Definition: PPAs are long-term contracts between a business and a renewable energy project developer. The business agrees to purchase the electricity generated by the project at a predetermined rate.

2. How It Works: Businesses sign a PPA to secure a stable, often lower, electricity rate over an extended period. This benefits both parties, providing financial stability for the project developer and cost predictability for the business.

3. Environmental and Financial Benefits: PPAs enable businesses to support and benefit from renewable energy projects. The long-term commitment fosters the growth of renewable energy infrastructure while offering potential cost savings.

How RECs and PPAs Can Benefit Your Business:

1. Carbon Neutrality: Offset your carbon emissions with RECs, achieving carbon neutrality and showcasing your commitment to sustainability.

2. Cost Predictability: PPAs provide cost predictability, shielding your business from volatile energy markets and potentially reducing long-term energy costs.

3. Renewable Energy Adoption: Both RECs and PPAs contribute directly to the growth and adoption of renewable energy sources, promoting a greener and more sustainable energy landscape.

4. Corporate Social Responsibility (CSR): Showcase your CSR initiatives by actively supporting and investing in renewable energy projects, aligning your brand with environmental stewardship.

5. Compliance with Renewable Energy Goals: Meet and exceed renewable energy goals, whether imposed by regulations, internal targets, or customer demands.

Energy CX: Guiding Your Sustainable Energy Journey: Get in touch with us for expert guidance on incorporating RECs and PPAs into your sustainable energy strategy. We streamline the process, ensuring a smooth integration of these sustainable solutions into your overall energy portfolio.

Unlock the potential of RECs and PPAs—redefine your business's energy landscape for a more sustainable and cost-effective future. #RECs #PPAs #SustainableEnergy #EnergyCXGuidance