Adapting to Rising Energy Prices: Strategic Insights for June 2024

Published on

In the energy sector, many of us have become accustomed to low spot natural gas and power prices. Now, with the futures market forecasting higher prices, we're faced with the challenge of adapting. Whether you're emerging from a contract or looking at a 2025 renewal, the fixed prices are notably high compared to recent spot market trends.

Analyzing Recent Trends

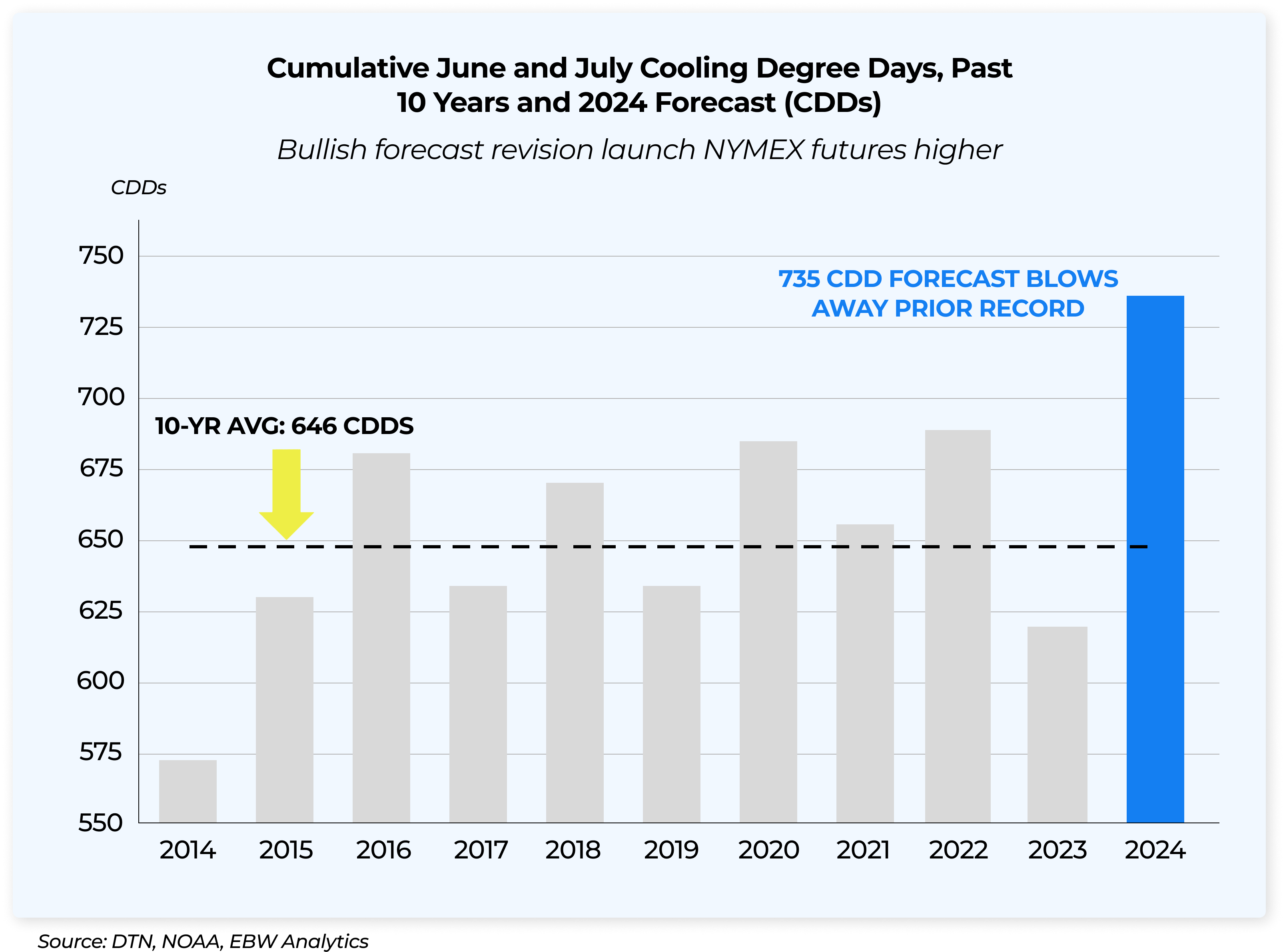

It's natural to focus on recent trends, but accepting the sharp rise in next week's PJM forward prices has been tough. An early summer heatwave has pushed forecasted loads to system-peak levels, driving on-peak prices into the 10+ cent per kWh range. While this spike may seem exaggerated, the heat is real, adding to the uncertainty.

It's natural to focus on recent trends, but accepting the sharp rise in next week's PJM forward prices has been tough. An early summer heatwave has pushed forecasted loads to system-peak levels, driving on-peak prices into the 10+ cent per kWh range. While this spike may seem exaggerated, the heat is real, adding to the uncertainty.

Natural Gas Market Dynamics

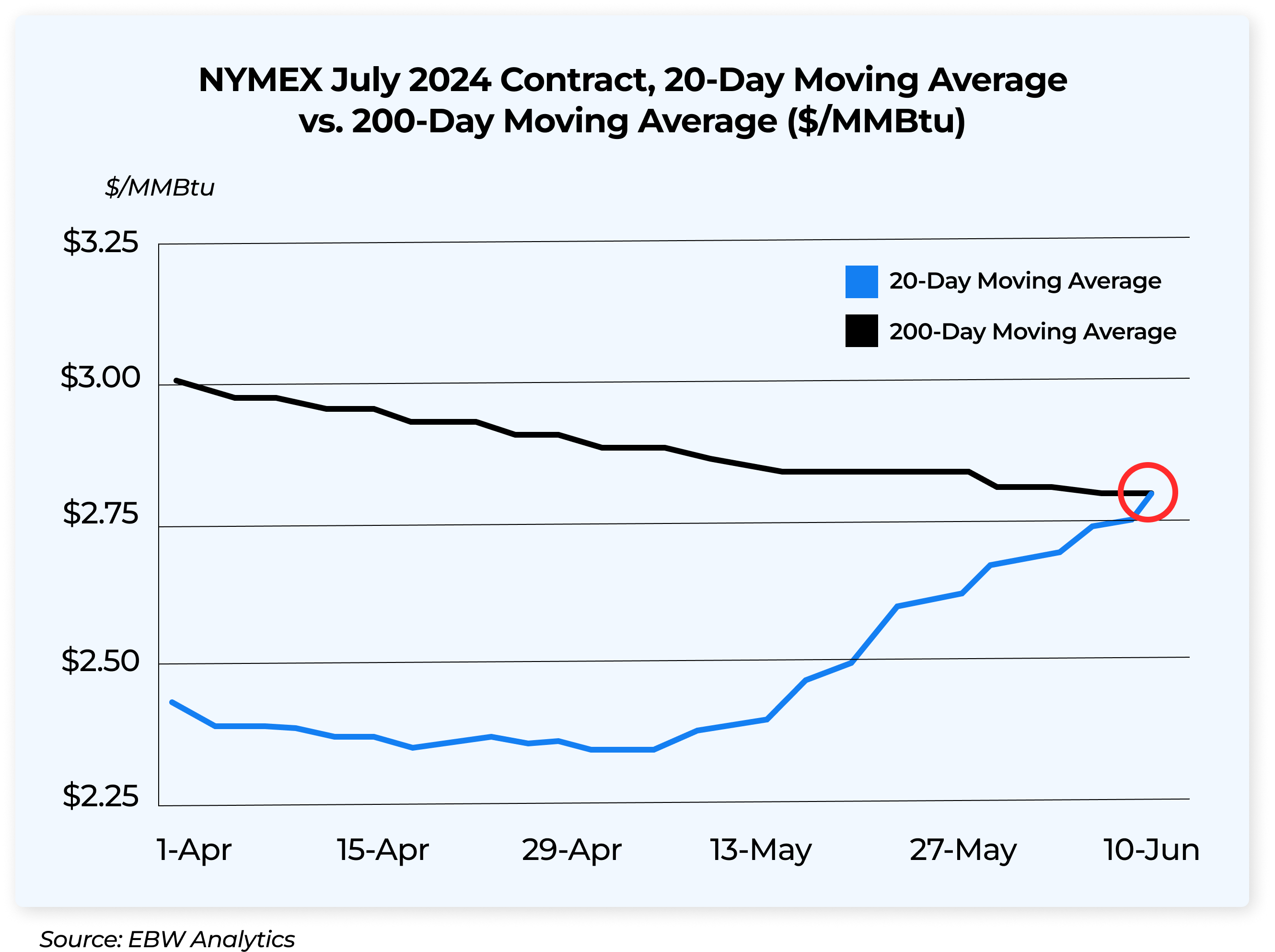

The natural gas market is also seeing significant shifts. With Freeport, a large natural gas export plant, fully operational and rising temperatures coinciding with poorly timed gas pipeline outages, short-term production is limited. As a result, $3 gas is back.

The natural gas market is also seeing significant shifts. With Freeport, a large natural gas export plant, fully operational and rising temperatures coinciding with poorly timed gas pipeline outages, short-term production is limited. As a result, $3 gas is back.

Several factors are influencing natural gas futures prices, which are inversely related to production:

- EQT Production Adjustments: EQT reduced production in March but resumed in late May, creating a bearish outlook.

- Chesapeake's Strategic Moves: Chesapeake cut output in northeast PA but is building inventory that can be quickly utilized when prices rise, presenting a bullish outlook now but potentially bearish later.

- Mountain Valley Pipeline Developments: The Mountain Valley Pipeline has requested FERC approval for commercial operation, contributing to a bearish outlook as EQT stages wells to supply the pipeline.

- Matterhorn Express Pipeline Delay: The Matterhorn Express pipeline has deferred its opening from July to October, which is bullish for the market.

Solar Output and Demand

Last summer's record power burn demand might not repeat this year due to a 40% year-over-year increase in U.S. solar output in May. This growth in solar energy could displace over 5 Bcf/d of gas demand, significantly impacting hourly prices.

Last summer's record power burn demand might not repeat this year due to a 40% year-over-year increase in U.S. solar output in May. This growth in solar energy could displace over 5 Bcf/d of gas demand, significantly impacting hourly prices.

Export Growth

Exports, especially to Mexico, are likely to be more impactful for demand. With new facilities coming online by Q4, there is room for growth. However, the large U.S. storage surplus tempers short-term bullishness, despite expectations for the surplus to narrow by year-end.

Strategic Recommendations

Exports, especially to Mexico, are likely to be more impactful for demand. With new facilities coming online by Q4, there is room for growth. However, the large U.S. storage surplus tempers short-term bullishness, despite expectations for the surplus to narrow by year-end.

Strategic Recommendations

Given the many competing variables and high uncertainty, it's crucial to move quickly through the stages of acceptance and develop a clear strategy. Straddling is essential—don't be deterred by fixed prices, but also don't rely solely on the spot market's performance. A balanced approach that exposes you to both ends is vital.

Strategy is key, and partnering with a strategic advisor like Energy CX is more relevant now than ever. With our data-driven methodology and innovative solutions, we can help you navigate these complex market dynamics. Don't face these challenges alone—reach out to Energy CX and ensure you have a robust strategy in place to manage rising energy prices effectively.

For more insights and strategic advice, stay tuned to our Market Insights section.