Market Update: June 26, 2024

This Week's Update:

Over the last week in the natural gas market, there was a clear bearish (belief that prices will fall) sentiment throughout the curve. The July ’24 natural gas contract is trading down $0.01 at $2.70. The prompt month (Jul) contract was down $0.18/MMBtu on the week and the middle of the curve, mainly Cals ’25-’30, were down slightly.

- Fundamentals:

- Production is up about 1.0 Bcf/d over the last seven days.

- Power burn and res/com demand have increased nearly 2.0 Bcf/d and almost 1.0 Bcf/d, respectively, during the same timeframe, LNG exports have been relatively unchanged, still near the 13.0 Bcf/d level.

EIA/Gas Storage: For the week ending June 14th, the EIA reported an injection of 71 Bcf into underground storage vs. an estimated injection of 72 Bcf. Inventories are 3,045 Bcf, 12.7% (343 Bcf) greater than the same period last year and 22.6% (561 Bcf) more than the 5-year average.

Weather impact:

- Weather forecasts for the next two weeks indicate the heat wave across the country will remain in place.

- Blistering heat is beginning to arrive across the Mid-Atlantic—and may settle in for the better part of the next month. Record heat to end June may extend with the July forecast to smash the hottest July of the past ten years.

In short:

- Natural Gas Prices have risen substantially since our benchmark lows in February. We continue to hold a bullish medium-term outlook for NYMEX futures, but incremental upside remains a highly weather-driven call. DTN is forecasting record July heat at 431 CDDs, with accompanying demand-pull strength likely to lead to upside potential for natural gas. If forecasts lapse, however, downside is probable.

- Based on current outlooks, we foresee a likely scenario in which NYMEX futures get more expensive over the next 30-45 days, particularly if the hot summer continues to arrive as predicted. Customers should look to take advantage of current fair-market value to hedge against potential summer price increases.

In Depth:

- Blistering record heat remains likely to lift NYMEX futures over the next 30-45 days—but upside remains a highly weather-dependent call. A hot back half of July and August may offer incremental cooling demand relative to the 10-year normal and likely upside for NYMEX futures over the next 30-45 days. Still, while probable, further upside remains highly dependent on fickle long-term weather forecasts.

-

While further medium-term upside is probable, NYMEX futures appear likely to ultimately relapse into the fall. Natural gas storage inventories surpassed 3,000 Bcf last week and could near 3,200 Bcf by the 4th of July. Supply is also likely to rise alongside higher prices as producers return deferred production and Canadian imports rise alongside higher US prices after a historically weak spring.

-

While weather-driven upside remains in the near-to-medium term, the combination of (i) returning supply, (ii) high absolute storage levels, and (iii) hurricane demand destruction risks suggest ultimate downside price risks into the fall. At some point this summer, record heat is likely to break and offer downside risks for natural gas. Hurricane demand destruction risks rise through early September. Steep declines in the storage surpluses vs. five-year average and year-ago levels decline begin to ebb as supply returns and relative LNG strength declines. Most concerningly, however, is projections for a US natural gas market awash in storage approaching 3,950 Bcf and above-average Canadian surpluses alongside a wave of returning production. While excitement for the upcoming winter and putting a bearish 2024 in the rearview mirror will help bolster prices, fundamentals suggest a period of weakness remains favored into early autumn. Critically, however, the long-term projected storage trajectory does not prevent prices from racing to unsustainable heights in the short-to-medium term. As a result, we remain constructive for the NYMEX outlook over the next 30-45 days—even if higher prices ultimately prove unsustainable in a majority of outcomes.

Natural Gas Prices:

.png?width=1720&height=1006&name=unnamed%20(1).png)

For contracts expiring in next 3 months (or NMR):

-

Why buy now?—DRT for 12-Month contracts starting in July and August below:

.png?width=1786&height=1029&name=unnamed%20(2).png)

.png?width=1786&height=1029&name=unnamed%20(3).png)

- General info regarding the start date: Gas is still relatively cheap vs. the past 24 months. There’s a lot of uncertainty about gas futures right now, especially in the near-to-medium term. With all the uncertainty, customers should consider adding to their portfolio while gas prices are fair.

For contracts expiring in 9-12 months:

.png?width=1786&height=1029&name=unnamed%20(4).png)

- Why buy now?—Gas 2025 renewals are still near their lowest since Jul ‘22. The contract price fell slightly since the last update (6/11/24).

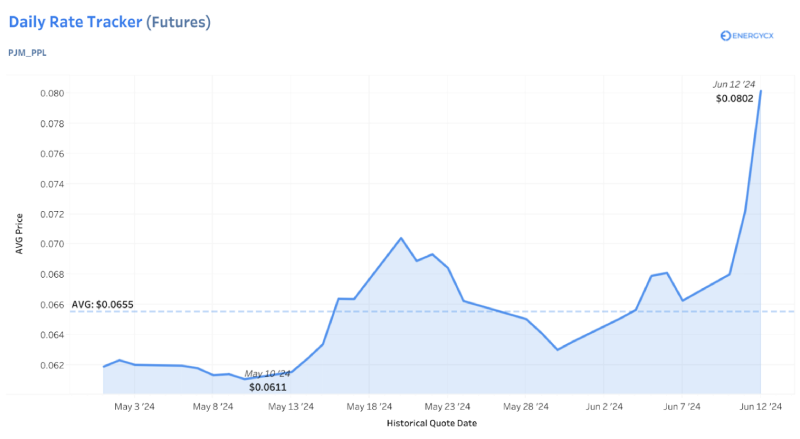

Electric:

.png?width=794&height=522&name=unnamed%20(5).png)

-

Spot Market prices have seen a substantial increase over the past few weeks in response to soaring summer demand.

-

This year, the transition from el Nino toward la Nina is rife with upside load—and price—risks. Peak loads could rip higher in MISO, PJM, NYISO—all regions that have seen narrowing reserve margins in recent years. The next two weeks may provide a substantial, long awaited test.

-

If this potential test is handled adroitly by regional grids— it may allow pricey forward contracts to finally retreat. On the other hand, in the less likely event that severe and recurring shortage pricing emerges, electricity futures could escalate rapidly. As a result, it appears possible that a volatile stretch for long-term electricity futures may follow from near-term grid performance in the weeks ahead.

-

Sizzling heat could send near-term loads flying— with elevated consequences for long-term futures risk premiums in many ISOs.

-