Unlock Energy Savings: Everything you Need to Know About Index Pricing

Published on

In the intricate realm of energy procurement, where every decision impacts the bottom line, navigating pricing strategies is paramount. One approach that stands out for its adaptability and transparency is index pricing. We'll delve into what index pricing entails, how it's calculated, and most importantly, how businesses can leverage it to save on energy costs.

What is Index Pricing?

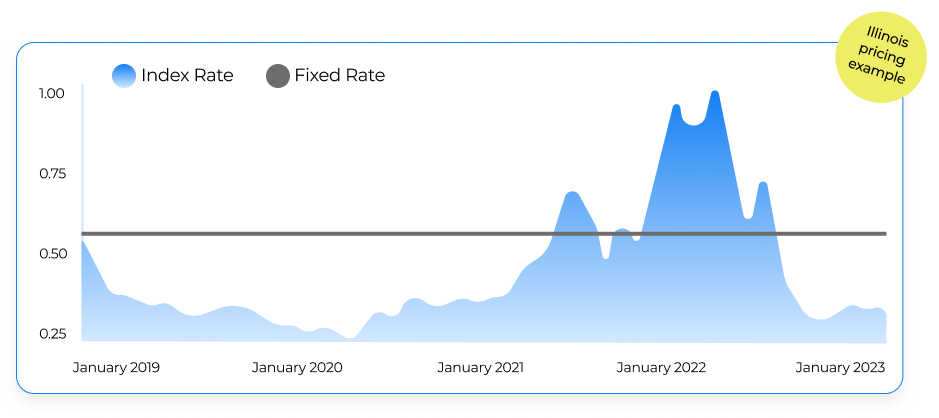

Index pricing is a method of determining the cost of energy based on a specific market index. Index outperforms fixed prices when insurance is not needed as our VP of Sales, Nathan Rice, says “don’t buy flood insurance for a house on the hill." Instead of a fixed rate, the price fluctuates in real-time, closely mirroring wholesale energy market conditions.

How is Index Pricing Calculated?

- Market Index Selection: The first step is selecting a market index that aligns with the specific energy market relevant to the consumer. This index serves as a reference point for pricing fluctuations. Common indices include the NYMEX natural gas index and regional electricity indices.

- Pricing Formula: The pricing formula typically involves adding a margin (the supplier's profit) to the current market index value. The resulting sum represents the consumer's energy price for a specific period.

- Real-Time Adjustments: Unlike fixed-rate contracts, index pricing allows for real-time adjustments based on market changes. This responsiveness ensures that consumers benefit from market lows while maintaining protection during spikes. 2023 has been an interesting year for index pricing with market lows. Our Head of Marketing Intelligence, Eddie Conlisk, further explains "given the low spot prices of natural gas due to excess supply and weak demand both gas and electric indexes performed extremely well most all of 2023."

Benefits of Index Pricing:

- Cost Reflectivity: Index pricing provides unparalleled transparency, allowing consumers to see a direct correlation between their energy costs and market movements. This transparency aids in budget planning and decision-making.

- Flexibility: The flexibility inherent in index pricing enables consumers to capitalize on market downturns. This adaptability is particularly advantageous in volatile energy markets. Our VP of Sales, Nathan Rice, explains "the index price is the market rate with no premiums attached to it. When markets remain calm, index prices outperform fixed rates, as we’ve seen in the last 4/5 years.”

Considerations and Potential Drawbacks:

- Price Volatility: While index pricing can lead to savings during market downturns, it exposes consumers to potential volatility. Sudden market spikes may result in higher costs compared to fixed-rate contracts.

- Budget Uncertainty: For businesses with stringent budget requirements, the fluctuating nature of index pricing may pose challenges in predicting and managing energy expenses.

How Energy CX Implements Index Pricing

- Market Intelligence: Our team of experts at Energy CX constantly monitors market trends, leveraging cutting-edge technology to provide real-time insights. This allows us to make informed decisions in the best interest of our clients.

- Strategic Planning: We work collaboratively with clients to develop a strategic energy purchasing plan. This includes identifying optimal entry points into the market, setting budget expectations, and defining risk management parameters.

- Continuous Monitoring and Adjustment: The energy market is dynamic, and so are our strategies. We continually monitor market movements and adjust our approach to ensure that our clients are positioned advantageously.

Conclusion:

In the ever-evolving energy landscape, an informed approach is key. Index pricing offers a dynamic alternative in energy procurement, providing adaptability and transparency. As consumers weigh the benefits against potential drawbacks, understanding their risk tolerance and business objectives becomes crucial in determining if index pricing aligns with their energy procurement strategy.

In the ever-evolving energy landscape, an informed approach is key. Index pricing offers a dynamic alternative in energy procurement, providing adaptability and transparency. As consumers weigh the benefits against potential drawbacks, understanding their risk tolerance and business objectives becomes crucial in determining if index pricing aligns with their energy procurement strategy.

Ready to navigate the energy market with confidence? Take advantage of market lows today and contact Energy CX. Let's chart a course toward a more resilient and cost-effective energy future.